Why NETA Electrical Contractors Command a Premium

Introduction to the InterNational Electrical Testing Association (“NETA”)

With electric grid reliance at the forefront of public discussion, the safety and compliance of electrical power systems is essential and requires frequent testing that meet rigorous standards. Accredited electrical contractors play a crucial role in maintaining the US electric grid and ensuring continuous operations of critical equipment and infrastructure is both possible and safe. The InterNational Electrical Testing Association (“NETA”) is charged with developing national standards as well as certifications for electrical testing that are highly regarded throughout the electrical contracting space.

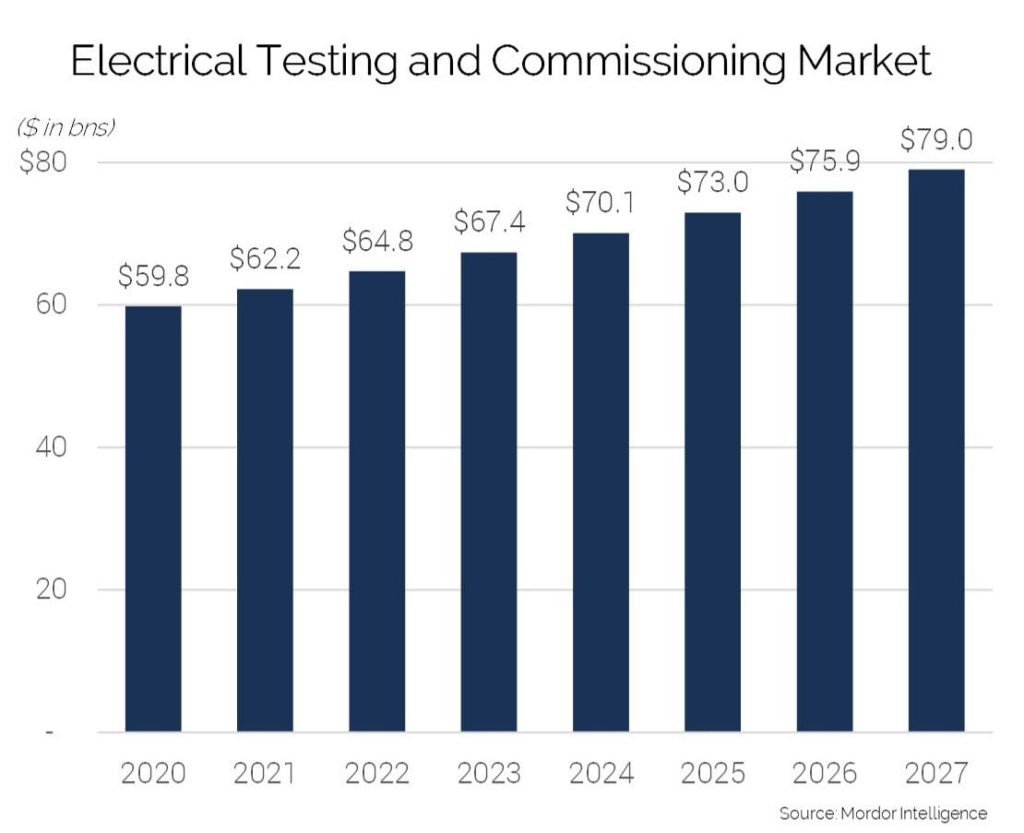

NETA technicians are in high demand due to their valuable and scarce skillset. With increasingly stringent regulatory standards, electrical equipment manufacturers, power utilities, and commercial properties commissioning equipment are required to test and maintain power systems with higher frequency. Further, with the amount of renewable power generating equipment anticipated to grow 400% by 2040, demand for well qualified NETA technicians is likely to grow along with the electrical testing and commissioning market, which is conservatively projected to grow to a $79 billion industry by 2027.

Value Drivers

Through discussion with active buyers and sellers in the market, Industria has identified the following as essential qualities that deliver value for exiting ownership upon a sale.

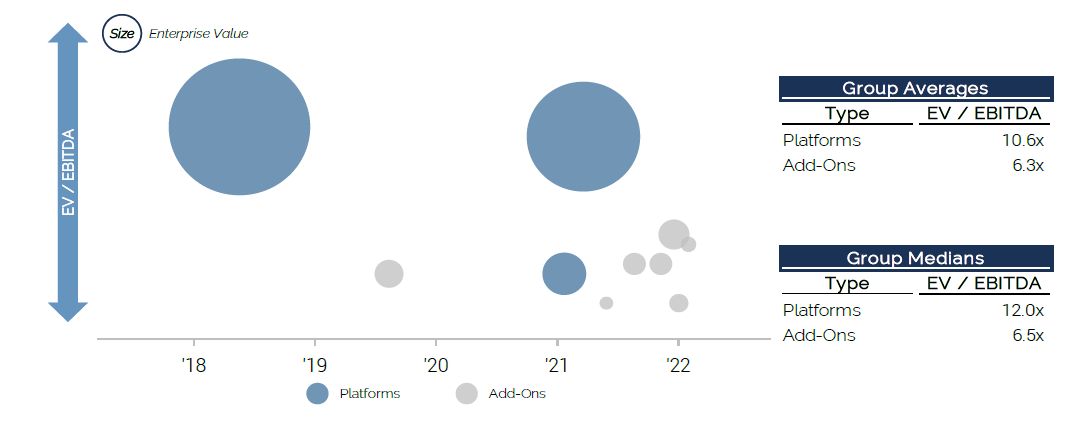

Size factors and earnings multiples – The NETA testing market is highly fragmented with mostly small contractors that receive valuations of 4-6x EBITDA, illustrating a large scarcity of mid-sized business in the space with sizable pools of certified technicians. Those with EBITDA of $1mm or more can receive valuations in the higher single digits while NETA contractors with more than $10mm of EBITDA and a larger base of certified technicians are likely to be valued at 10x EBITDA or higher.

Scalability – Similar to other competitive markets, professionalization of management and processes are rare yet essential building blocks for scaling. For private equity firms seeking platform investments, an experienced executive suite as well as well integrated systems that facilitate optimal operations are essential contributions to value determination.

End Market exposure – While NETA testing is applicable throughout end markets and the many power systems utilized, certain market exposure is viewed more favorably than others. Battery storage, renewable energy, and data center work is considered favorable, while new construction, government, and educational facility work is seen as less attractive.

Revenue mix – NETA related testing and maintenance services deliver recurring and reoccurring revenue streams, providing greater visibility into future earnings. Further, these services are more labor intensive versus traditional electrical contracting, which requires high material inputs. Both a high degree of recurring and reoccurring revenue as well as revenue attributed to labor are meaningful to potential acquirers.

Industrial electrification – The call for a reduction in scope two greenhouse gas emissions has led to an increased amount of centralized renewable energy generation. This has caused the price of renewable electricity to decrease, stimulating an increased amount of industrial electrification. As more industrial and manufacturing plants incorporate renewable energy into their purchased energy portfolios and begin to switch to electrical or hybrid equipment, NETA certified technicians and companies will see an increase in value.

BESS – For an increased reliance on renewable energy to be feasible, battery energy storage systems (“BESS”) must be able to store and supply an excess amount of energy demanded. BESS will integrate with today’s electrical grid and discharge less carbon intensive energy during peak demand, and during periods where renewables aren’t delivering. The success and growth of the BESS market will likely contribute to future value determination for NETA businesses.

Electric vehicles – NETA accredited companies will play a pivotal role in accelerating the growth of EV charging infrastructure. Currently, the United States aims to have 500,000 public chargers installed nationwide by 2030, all of which will require testing and inspection. NETA accredited companies that work with EV charging infrastructure will capitalize on this industry expansion and likely increase in value.

Mergers and Acquisitions Update

As an industry ripe for consolidation, various private equity backed platforms are deploying capital to grow through the strategic acquisition of NETA certified contractors. Based on platform and add-on transactions in recent years, M&A in the NETA market is likely to continue at a strong pace with favorable valuations. Platform acquisitions are receiving premium valuations while add-ons are receiving lower, yet healthy value.

With various private equity backed platforms employing an aggressive acquisition strategy to secure a place in the NETA contracting market and deliver value to customers and shareholders alike, it may be a prime time for owners to contemplate an exit. Valuations are being driven higher, and platform companies are hungry for acquisitive growth.

We hope you found this insightful. Please feel free to contact anyone on the Industria team – we would welcome the opportunity to discuss our viewpoints. Don’t wait. Let’s start the conversation.

Go back