Going Down? Interest Rates and M&A Valuations

While there are sector- and company-specific factors that drive valuation, which we’ve explored in previous articles such as Why NETA Electrical Contractors Command a Premium and Outsourced Utility Services, this article focuses on the impact of economic cycles on the M&A market, discussing how key issues – economic uncertainty and interest rates – affect valuation.

Economic Uncertainty & Interest Rates

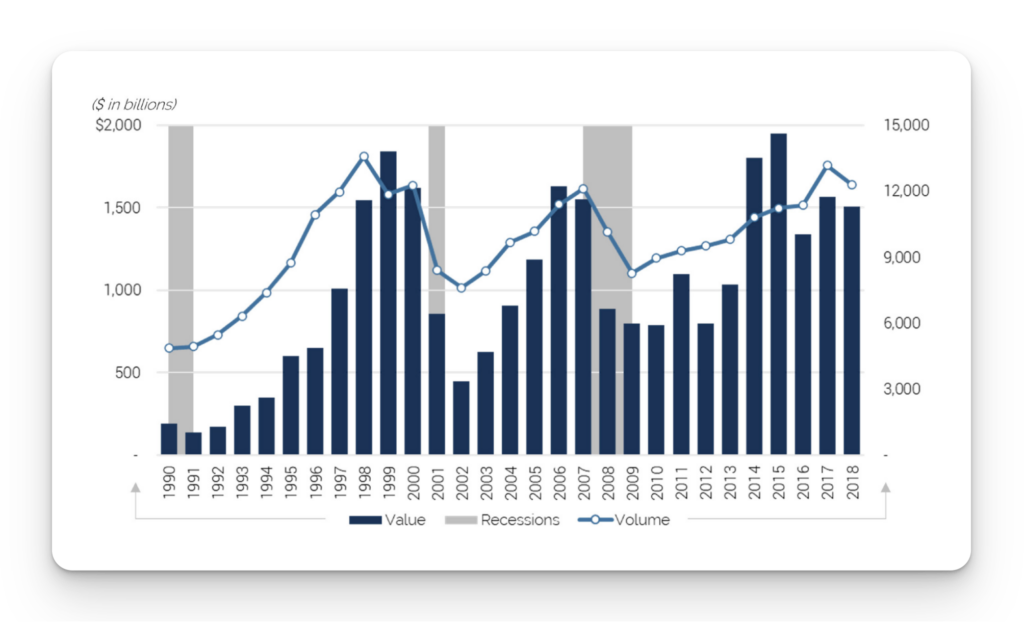

There’s an ongoing debate as to whether the US is heading for a recession or if the worst of it is behind us. Some see looming storm clouds while others have a more optimistic outlook for this year’s M&A market. While various industries or regions contribute to specific forecasts, this overall uncertainty has impacted M&A activity. In a typical cycle, M&A valuations and volumes tend to mirror that of the economy, rising or falling in tandem as the economy expands or shrinks.

Today, with uncertainty building around a potential recession, companies and their management teams are more cautious in pursuing large investments – such as an acquisition – for fear of overextending their organizations if the economy weakens. This perceived increase in risk results in lower valuations and decreased overall deal volume as shown below.

In addition to the uncertainty surrounding the direction of the market, interest rates have been rising as the Federal Reserve works to fight against rising inflation. At its first three monetary policy meetings of 2023, the Fed raised the fed funds rate, bringing the cost of borrowing to the highest level since 2007.

Under normal market conditions, a lower cost of capital incentivizes M&A activity and increases both deal volume and value, similar to how lower mortgage rates incentivize homebuyers and expand affordability. The inverse is also true. In our current environment, rising costs of debt, a key component of most mergers and acquisitions, deters buyers as the higher cost of borrowing reduces potential returns from a transaction. Sustained high-interest rates can also lead to a decrease in overall economic activity, making it more difficult for acquirers to justify the cost of transactions as a target’s future growth may slow. These factors, along with other secondary impacts of high interest rates (changing investor sentiment, lower public stock prices, etc.), adversely affect the M&A markets, putting additional downward pressure on valuation and further reducing M&A volume.

Impact to M&A Valuations

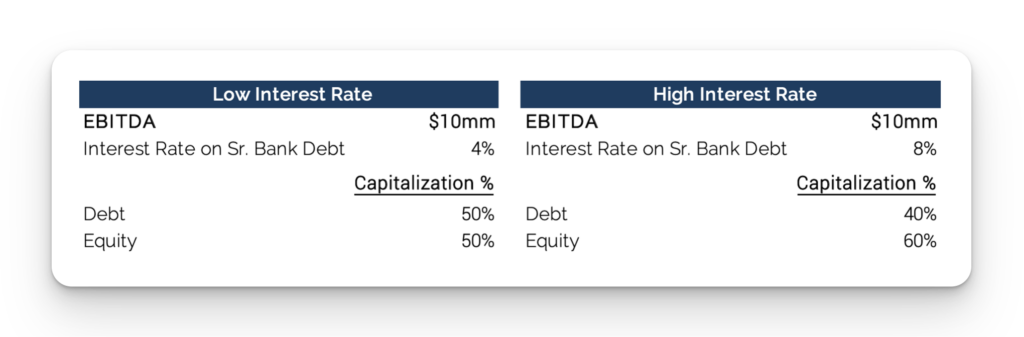

To quantify the effect of economic uncertainty and rising interest rates on M&A valuations, Industria modeled an example transaction based on a company that generates $10mm in EBITDA, and then made assumptions around on low- and high-rate interest environments, which are shown below.

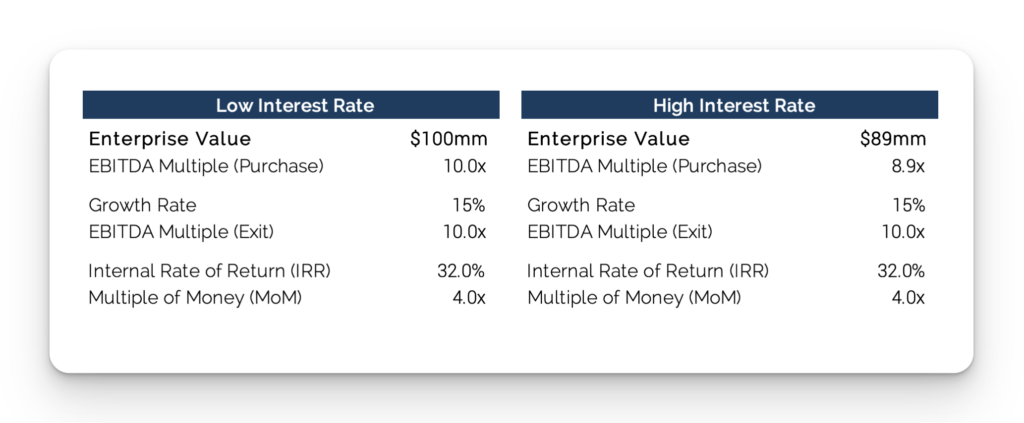

The reduced availability of capital is another way that high-interest rates affect M&A transactions. To account for this, we adjusted the transaction’s financing from a 50/50 debt-to-equity structure in the low-rate environment to a 40/60 debt-to-equity structure in the high-rate environment. With the structure of the deal in place for each scenario, we applied a 10x purchase multiple (EV/EBITDA) to the business in the low-interest rate environment and calculated the returns an investor would achieve if they exited the business after 5 years (at a 10x exit multiple).

Using these same assumptions, we then analyzed the impact of high-interest rates and corresponding capital structure by backward solving for the returns achieved in the low-rate scenario. To achieve the same returns in the high-rate scenario, an investor would have to lower their purchase multiple from 10x to 8.9x even if the assumed growth rate is the same, which most likely would not be the case.

By isolating interest rates and capital structure, we calculated that the buyer must discount purchase multiples by greater than one turn of EBITDA to achieve the same results in a higher-rate environment that they would have achieved with the same company in a low-rate environment. While this analysis assumes that all else is equal, in practice other considerations such as growth prospects, perceived risk, and investor sentiment all play into the valuation of a business. Because these factors are often less favorable during times of economic uncertainty, additional discounts are often applied, resulting in enterprise values (purchase prices) that are lower. For example, a 10x multiple could decrease to an 8x multiple, or less.

Although today’s market conditions typically put downward pressure on valuations, opportunities to achieve full value still exist for sellers. Top tier businesses in select sectors continue to attract strong buyer interest and companies with high free cash flow that can quickly pay down the more expensive debt are viewed favorably. As a result, despite overall market uncertainty and increasing interest rates, mergers and acquisitions will continue to occur if valuation expectations from both sides of the transaction remain tethered to capital market conditions.

Conclusion

While economic uncertainty and rising borrowing costs have negative effects on M&A markets, they also present opportunities for businesses to pursue strategic acquisitions that diversify their revenue streams and reduce risk. By leveraging our expertise in industrial, infrastructure, climate, and energy industries, Industria is uniquely positioned to help clients navigate these challenges and unlock full value. Our team of experienced advisors understands that every transaction is unique, and we work closely with owners and management teams to develop bespoke solutions that deliver superior outcomes. With our deep industry connectivity, transaction experience, and expert execution, Industria is the ideal partner for entrepreneurs, family-owned businesses, and private company owners looking to achieve their M&A and capital needs.

Go back