Expanding into Renewables

Renewable and low-carbon infrastructure has experienced compounding growth over the last decade as the United States public and private markets continue to strive for net-zero emissions. This energy transition has provided a platform for all types of service providers to support wind, solar, energy storage, electric vehicle, and industrial decarbonization infrastructure development.

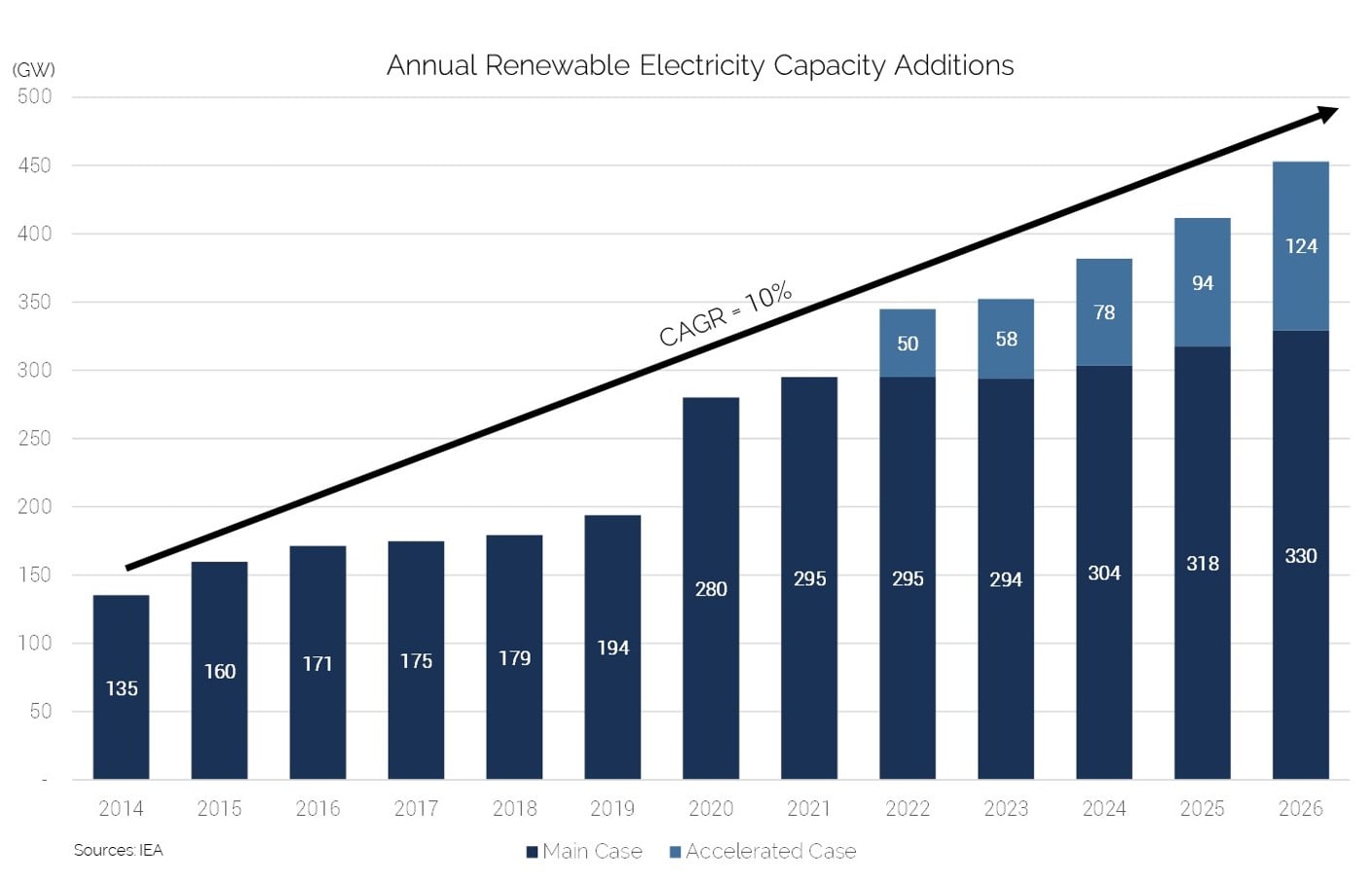

In 2021, a record 295 gigawatts (GW) of renewable utility-scale electric generating capacity was added to the global power grid, representing a 5% increase over the prior year. Capacity installations are expected to increase an additional 8% in 2022 and continue to increase every year that follows.

Investments from utilities – Over the next year and a half, United States investor-owned electric utilities will deploy $140b in capital investments for clean energy technologies and grid decarbonization.

Electric vehicle infrastructure – The EV Charging Action Plan, announced at the end of 2021, allocates $7.5 billion for the construction of a national network of 500,000 electric vehicle chargers. This new network will need to be designed, installed, tested, and maintained by outsourced providers.

Battery energy storage systems – The U.S. Energy Information Administration (EIA) expects U.S. utility-scale battery storage capacity to grow by 5.1 GW, or 84% in 2022. The majority of these installments are co-located with renewable energy power plants, resulting in an increased amount of serviceable infrastructure at any given renewable project.

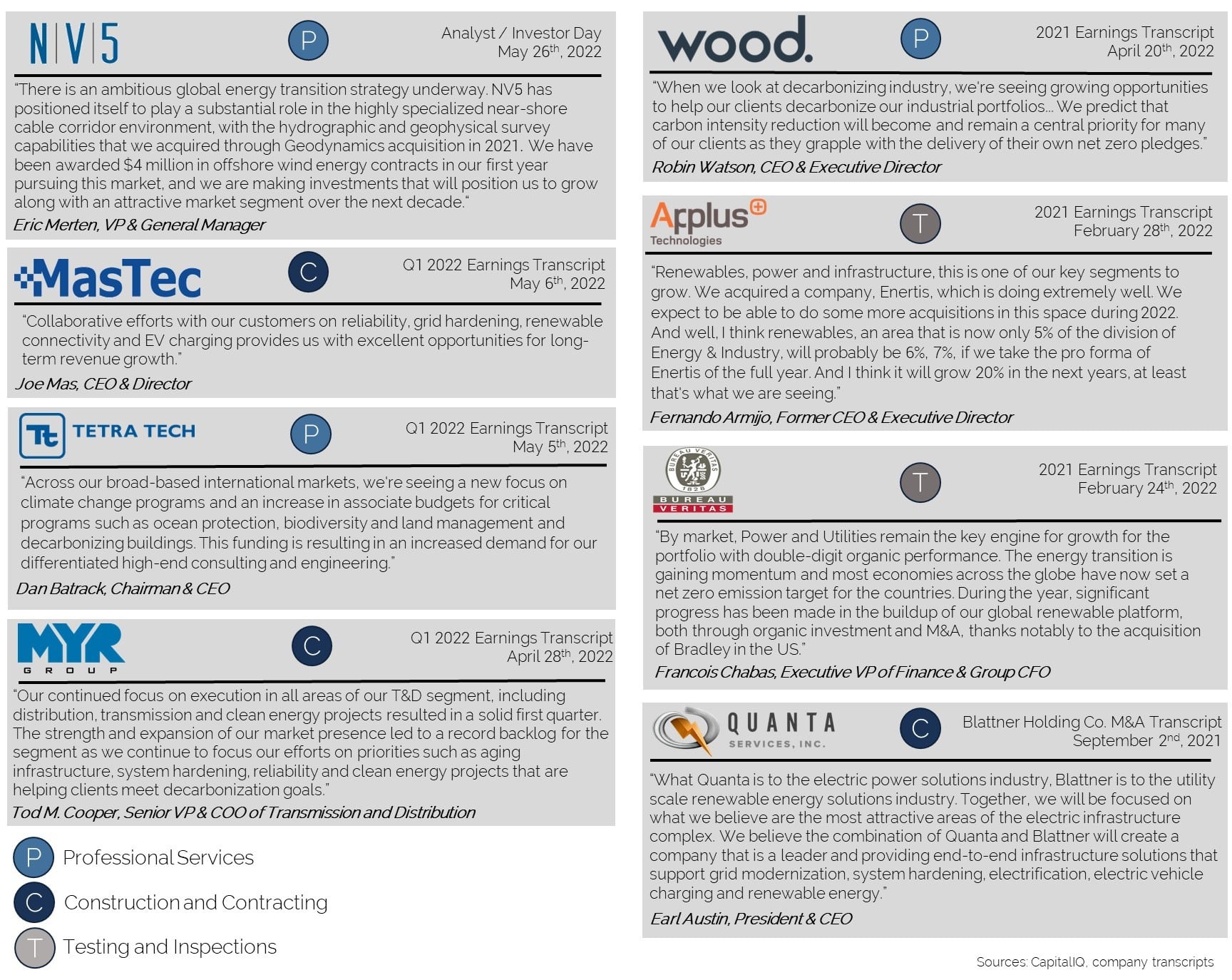

Public Companies: Straight From the Source

Many public companies involved in traditional infrastructure services have recently discussed commitments, goals, and expectations for future expansion into the renewable energy sector. Below are a select handful of public service companies that plan to pursue opportunities in clean energy transition.

Public service companies have also expanded into renewable energy through acquisitions as well. MasTec recently entered an agreement to acquire Infrastructure and Energy Alternatives (“IEA”), which will significantly increase its exposure to renewable energy projects.

M&A Activity: End Market Expansion

To capitalize on the tailwinds associated with energy transition and decarbonization, private companies and private equity backed platforms are also making strategic acquisitions of renewable energy service providers to expand core capabilities into these markets.

Middle Market Implications

Providers of decarbonization and sustainability solutions will undoubtedly be in high demand for the coming years as companies around the world commit to new ESG initiatives and climate reduction pledges. With this growth extending into the foreseeable future, many middle-market businesses are expanding their services into renewable end markets or consolidating with larger infrastructure service platforms. As a result, we expect to see an increase in acquisition volume for middle-market service providers in the coming years. Businesses that offer services not traditionally defined as decarbonizing but that have a measurable and material impact on carbon footprints should promote those characteristics heavily.

We hope you found this insightful. Please feel free to contact anyone on the Industria team – we would welcome the opportunity to discuss our viewpoints. Don’t wait. Let’s start the conversation.

Go back